Concept of cost product in Odoo

In Odoo, an "Expense Product" is a product type used to represent expenses, service fees, or other items that are not physical goods that you can purchase. or sell. Specifically, cost products are often used to record support costs or fees related to business activities, such as transportation costs, maintenance costs, service fees, and administrative costs. , and other types of costs.

Using the expense product in Odoo helps you manage and track expenses in an organized and effective way. By using cost products, you can:

- Record and classify expenses in a detailed and clear way.

- Track expenses by project, department or different financial sources.

- Calculate and report on the total costs of the business according to different criteria.

- Manage the confirmation and payment process for expenses.

The cost product in Odoo is often used in conjunction with other modules such as Project Management, Accounting Management, or Purchase Management to create a comprehensive and effective cost management system.

How to configure spending products in Odoo

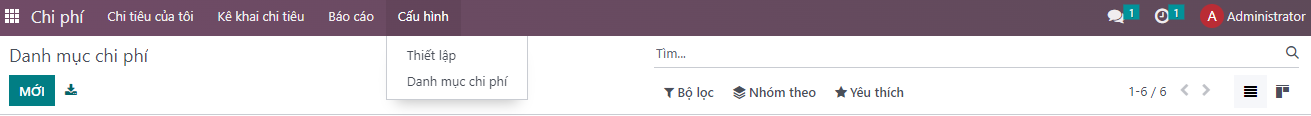

Before you start recording expenses, you need to set up "Expenditure Products" following the path: Expense Module -> Configuration -> Expense Categories.

Steps to create a cost product

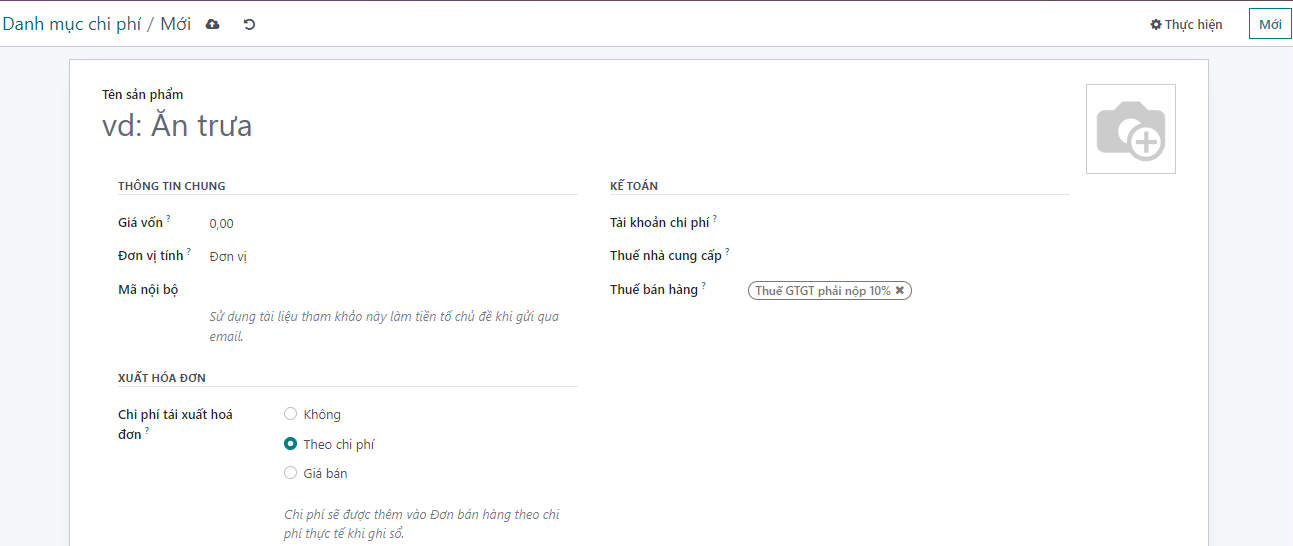

- You select "Create"

- Enter "Product Name"

- Enter "Product Type":

+ Consumption: Used for internal consumption products, only managing quantity, not managing warehouse entries.

+ Service: Used for service-type products.

+ Can be stored: Used for imported products for sale or imported products for gradual use.

- Enter Cost price if the cost has a fixed price. Otherwise, keep Cost at 0.00, the employee will report the actual cost per expense.

- Select Unit of measurement.

- Enter Internal Code: Is the abbreviated code of the product.

- Enter Accounting information:

+ Expense account: If the accountant wants to set up this expenditure product into a separate expense account.

+ Supplier tax: Tax applied when purchasing goods.

+ Customer Tax: If there is a need to re-export this invoice to the customer. This information field will appear when you select Cost Price or Selling Price at Re-invoice Expenses.

- Select Invoicing Policy: When this Expenditure is associated with a Product that needs to be invoiced to the customer, the invoicing policy will be in two ways:

+ According to order quantity: The quantity and value of goods on the invoice are based on the quantity and value on the sales order and do not depend on whether or not they have been delivered from the warehouse.

+ According to the quantity delivered: The quantity and value of goods on the invoice are based on the quantity of goods delivered at the delivery warehouse and the value on the sales order.

- Select Re-invoice Cost:

+ No: Spending associated with this product will not need to be re-invoiced to the customer.

+ By Cost Price: Expenditures associated with this product are invoiced back to the customer at a price equal to the actual price the company paid.

+ Selling price: Expenditures associated with this product are invoiced back to the customer at the selling price specified by the company.

- Then click Save, the system has successfully created the Expenditure Product.

Above is how to create a cost product in Odoo. To understand more about Odoo and have solutions suitable for businesses when implementing Odoo. Please contact us immediately via the information below:

Address: 16/117 Nguyen Son, Gia Thuy Ward, Long Bien District, Hanoi, Vietnam

Phone: +(084)943730142

Email: erptoancau@gmail.com

Website: https://erptoancau.com